Register For Free!!

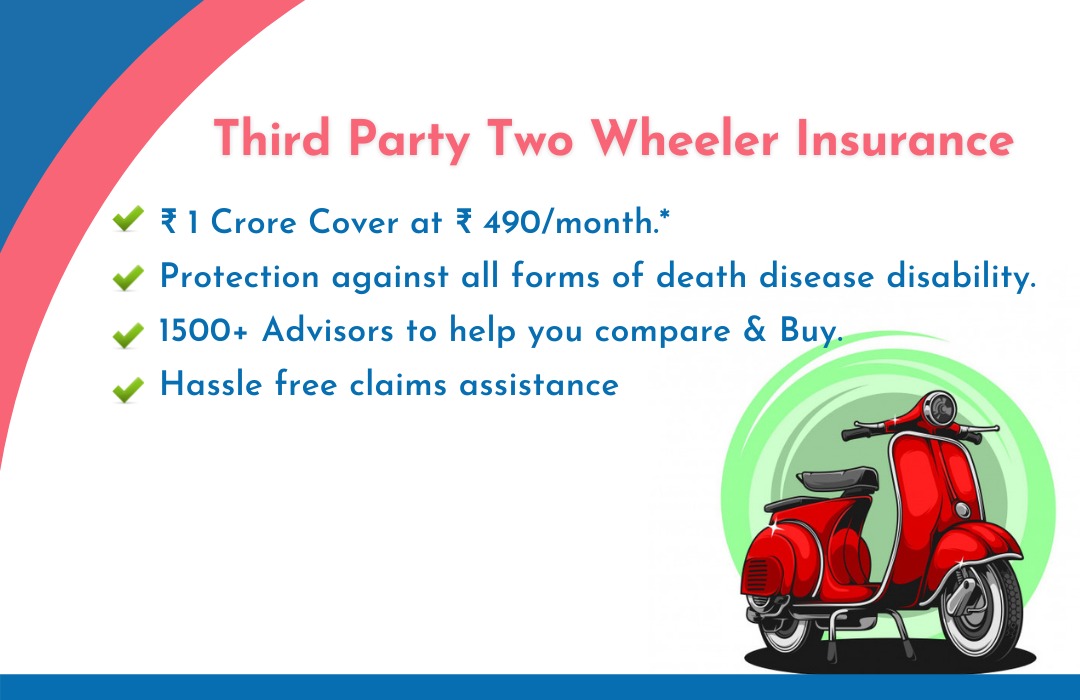

Third Party Two Wheeler Insurance

Two wheeler insurance is taken to cover against any damages that may occur to a motor cycle or its riders due to an unforeseen event like an accident, theft or natural disaster. Also provides protection against liabilities arising from injuries to one or more individuals due to the accident. The bike insurance cover provides protection to all types of two wheelers.

There are two types of Insurance:

Comprehensive

This covers against all types of wear and tears to the vehicle and its riders.

Liability-only

This covers only against injuries arising from third-party action.

Choosing any one these above mentioned covers varies from person to person. These polices also have add-on covers as mentioned below.

Instant Policy

In the earlier days, customers buying or renewing a two wheeler policy would get a cover note and not the policy itself. The main bike insurance policy document was mailed to them at their address at a later date. With the emergence of new technology and faster banking facilities, a digitally signed policy is nowadays issued immediately to the policyholder at the time of making the payment to either buy or renew.

Optional Covers

These include personal accident cover for pillion riders, enhanced cover for spare parts and accessories. The additional coverage costs extra but is very helpful for the rider.

Easy transfer of No-Claim Bonus

The insurance companies offer easy transfer of the No-Claim Bonus discount if the person buys a new vehicle. This is given to the owner and not to the vehicle. The easy transfer option means that the person is rewarded for safe driving practices and for not making a two wheeler policy claim in the earlier years.

Discounts

IRDA approved insurers provide discounts for certain factors such as membership of a recognized automotive association, discount for vehicles that have approved anti-theft devices, etc. Owners with an unblemished record also receive concessions in NCB (no claim bonus).

Easy transfer of No-Claim Bonus

The insurance companies offer easy transfer of the No-Claim Bonus discount if the person buys a new vehicle. This is given to the owner and not to the vehicle. The easy transfer option means that the person is rewarded for safe driving practices and for not making a two wheeler policy claim in the earlier years.

Discounts

IRDA approved insurers provide discounts for certain factors such as membership of a recognized automotive association, discount for vehicles that have approved anti-theft devices, etc. Owners with an unblemished record also receive concessions in NCB (no claim bonus).

Online Purchase or Renewal

The insurance companies offer online purchase or policy renewal through their websites and sometimes even through mobile apps. This makes it easy for the policy owner to get their needs fulfilled. Since all prior two wheeler policy claim or additional details are already in the database, the bike insurance renewal process is quick and highly convenient for the customer.

Benefits of Two Wheeler Insurance

- Quick Policy

- Comprehensive and Liability Only Coverage

- Optional Coverage

- Discounts

- Easy Transfer of No Claim Bonus (NCB)

- Property damage and/or physical injury coverage in surroundings Quick Registration for Online Purchase

Articles

- What to Keep in Mind When Buying Two wheeler insurance Policy for Your Sports Bike?

- What Is Covered Under Third Party Car Insurance Policy?

- What is Engine Protection Cover in Auto Insurance?

- Everything You Need to Know About Theft Cover of Two Wheeler Insurance Plans

- How a Zero-Dep Car Insurance Policy Benefits You during Claims?