Register For Free!!

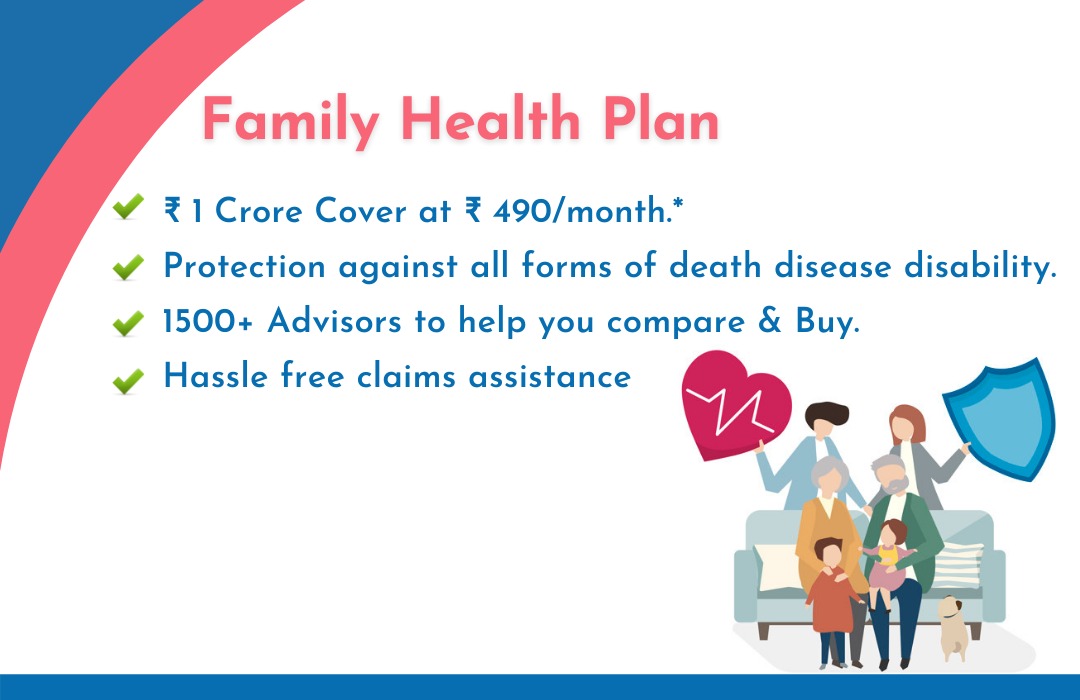

Family Health Plans

As the name suggests, family health plan are insurance plans, which covers more than one member of a family for a fixed sum assured in exchange for a single annual premium. This policy can cover more than 2 members at same time.

There are two types of family health plans available in the market.

- Medical Insurance: A medical insurance policy typically reimburses the hospitalization cost subject to healthcare treatment. The insurance company bears the expense in the form of cashless treatment or reimbursement

- Critical Illness Insurance: This policy covers a policyholder against chronic diseases like heart attack, stroke, kidney failure, organ failure etc. As per the policy coverage, the insurance company pays lump sum assured to the policyholder. There is a problem in purchasing such a plan, as one CIL can’t be purchased of entire family it has to be individual policy.

How to determine which family plan is good, need to understand the following:

- Coverage provided for a family plan: Need to understand what does the plan cover; the most important is, to check it covers out-patient expenses, in-hospitalization expenses, ambulance charges, etc. Need to check if there is a provision for a new born baby or not. If there is then should have the baby added to the list of family members.

- Maximum Renewal Age: Most of the health insurance companies offer policy renewal till 60-65 years. Nowadays, some health insurance companies also offer lifelong renewal facility. Make sure to choose the family floater health plan that would protect you when you need it most.

- Hassle-Free Claim Settlement: Most of the health insurance companies follow the same claim process as directed by the insurance regulator. Check out the policy that settles claims faster and opt for it, also understand the entire filing process, whether they provide cashless for reimburse after discharge.

- Tax Benefits: Insurance premium paid in any mode other than cash is eligible to get tax under Section 80D of the Income Tax Act.

- No Claim Bonus: Check out policies which provide no claim, bonus if in case a person doesn’t use it for a year.

Health Insurers

- Aditya Birla Health Insurance

- Apollo Munich Health Insurance

- Bajaj Allianz Health Insurance

- Bharti AXA Health Insurance

- Cholamandalam Health Insurance

- Cigna TTK Health Insurance

- Health Insurance

- Edelweiss Health Insurance

- Future Generali Health Insurance

- HDFC Ergo Health Insurance

- IFFCO Tokio Health Insurance

- Kotak Mahindra Group Health Insurance

- Kotak Mahindra Health Insurance

- Liberty Health Insurance

- LIC Jeevan Arogya Plan(Health Insurance)

- Max Bupa Health Insurance

- National Health Insurance

- New India Health Insurance

- Oriental Health Insurance

- Raheja QBE Health Insurance

- Reliance Health Insurance

- Royal Sundaram Health Insurance

- SBI Health Insurance

- Star Health Insurance

- Tata AIG Health Insurance

- United India Health Insurance

Articles

- Family Health Insurance vs Family Floater Plan: What to Buy?

- Buying a Health Insurance Plan for your Family? Here are the Things you should know

- How Important Is Health Insurance for Your Family?

- 9 Pointers for How You Can Best Utilise Your Health Insurance

- Why Family Health Insurance Plan Needs a Timely Re-evaluation