Register For Free!!

Term Insurance

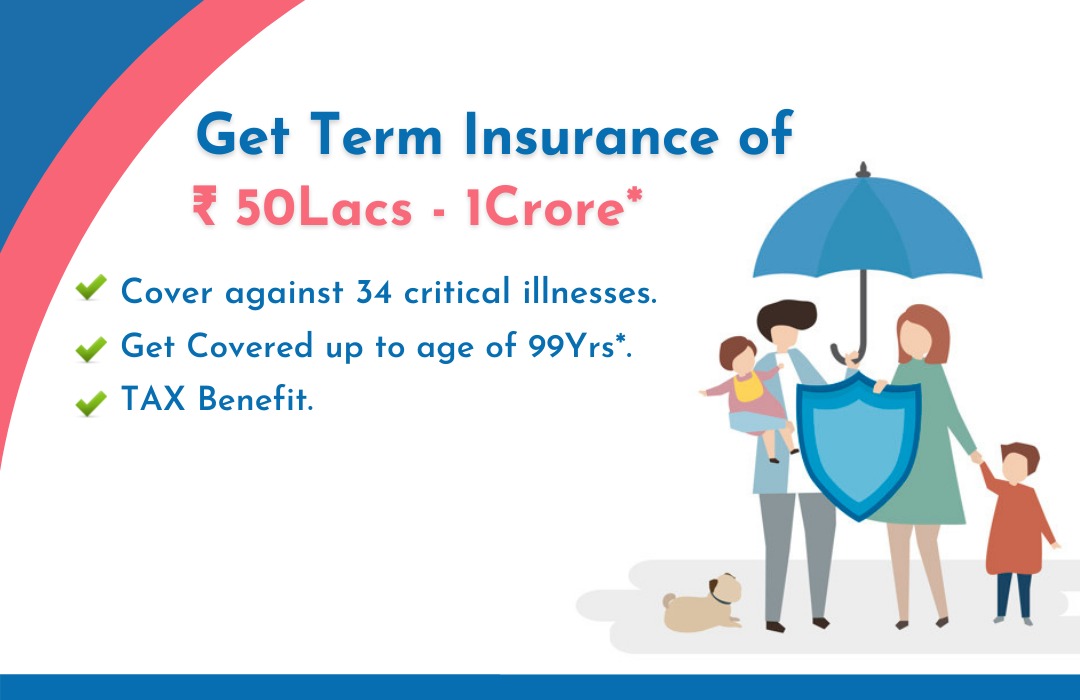

It is an insurance plan, which provides financial coverage to the person insured for a certain period of time, it provides the person who has taken the term insurance an assured sum of money after the period of the policy expiries; In this case the person doesn’t have to a deceased. However if the person is deceased then the family gets an assured sum lump sum to take care of their needs in the years to come. Term plans are now the most sought after insurance plan by an individual, since it has a couple of advantages to it.

- It helps in clearing off loans and liabilities.

- It helps family to continue to live happily.

- The lump sum amount helps provide illness cover for all types of illness for the family.

- The plan has an addition rider; it provides additional money for accidental death.

- The plan is designed in such a way that in case of death or any uncertain case, the plan payout will ensure the family is secured.

These Insurance Plans are designed, in such a way that in case of death or uncertainty a family's core financial needs are taken care of. This helps a family to have sound financial independence, even if the ensured is not around, with tax benefits.

Time frame of Policy

The minimum policy term is 5 years, with the maximum varying from 25 years to whole life span for equated monthly premium payments. Premium varies for different age group and most of the time is either a single premium or monthly. This is as per the term taken. The plan comes with a benefit, in case a person thinks that the plan is not as per their liking then they can opt out of it. Once the plan is in motion then the amount invested is blocked for the entire term of the plan.

Different types of Plans

Term insurance provides flexibility in terms of selecting plans on single life basis or joint life basis. Single life means the ensured is protected for a span of time mentioned in the plan.

A joint life plan covers the ensured and the family member in one term. Also the term pays each of the insured persons.

Eligibility

A person should be minimum 18 years and maximum of 65 years of age to able to get a Term insurance plan. Premiums will vary with a bracket of 5 years (age group). If the person is young in age then the Term plans are very beneficial as they have a locked-in premium amount that does not change much most of these term plans.

Maturity Age

The best term insurance plans are those that offer cover well into the lifetime of the insured. Max plans give cover up to 65 years of age, but in some cases till 70 years.

Survival Benefits

No term plan has any survival benefits. Such huge is the demand from investors has meant that many companies have opted to launch such plans with survival riders.

Called as Term again of Premium plans, the term plan refunds the premium at the end of the term plan tenure if the insured person survives the period.

This plan is changing into a fad for those who are trying to find savings similarly as insurance with their term plan This plan incorporates a higher premium than the regular one has the advantage of assurance that the person can go back to the premium he or she paid to the insurance company.

Death Benefits

When the insured dies when the term plan is still going on the nominee or whoever has been mentioned in the policy gets the total sum as per the plan. As per the plan, the death benefit may remain same over the whole tenure of the plan (standard term plans), decrease (decreasing term plans) or increase (increasing term plans). The company provides various options of payment for the term plan, which may include lump sum payout, lump sum payout with an annuity that may be monthly, quarterly or yearly.

Additional Rider Benefits

This option includes critical illness and accidental death or disability. These riders come with an additional cost other than the already paying premiums. If one chooses to go for any rider then he/she ahs to shell out some more amounts and this comes in handy. The riders available are:

- Hospital Cash Rider

- Accidental Death benefit rider

- Waiver of premium rider

- Critical illness Rider

The best way to choose a term insurance plan is to look for the following:

- Company Reliability: Which company is reliable and stable in the market, and which is the best compared to reliability.

- Expense: Premiums of the term plans vary from company to company and we need to choose as per the budget suited to us.

- Enhanced Cover: t is a special option provided by the online terms plans of specific insurers the chance to enhance their life cover at their critical situations of the life of the policyholder.

- Claim Settlement ratio: The number of claims settled against the plans issued.

- Riders: Choose plans that give riders, as they are vital if a person is looking to insure family members also.

- Solvency Ratio: Financial goodwill of the insurance company, regarding settling pending claims without becoming bankrupt.

Term Insurers

- Aegon Life Term Insurance Plans

- Aviva Term Insurance Plans

- Bajaj Allianz Term Insurance Plans

- Bharti AXA Term Insurance Plans

- Birla Sun Life Term Insurance Plans

- Canara HSBC Term Insurance Plans

- DHFL Pramerica Term Insurance Plans

- Edelweiss Tokio Term Insurance Plans

- Exide Life Term Insurance Plans

- Future Generali Term Insurance Plans

- HDFC Life Term Insurance Plans

- ICICI Prudential Term Insurance Plans

- IDBI Federal Term Insurance Plans

- IndiaFirst Term Insurance Plans

- Kotak Life Term Insurance Plans

- LIC Term Insurance Plans

- Max Life Term Plans

- PNB MetLife Term Plans

- Sahara Life Term Plans

- SBI Life Term Plans

- Shriram Life Term Plans

- Star Union Term Plans

- Tata AIA Term Plans