Register For Free!!

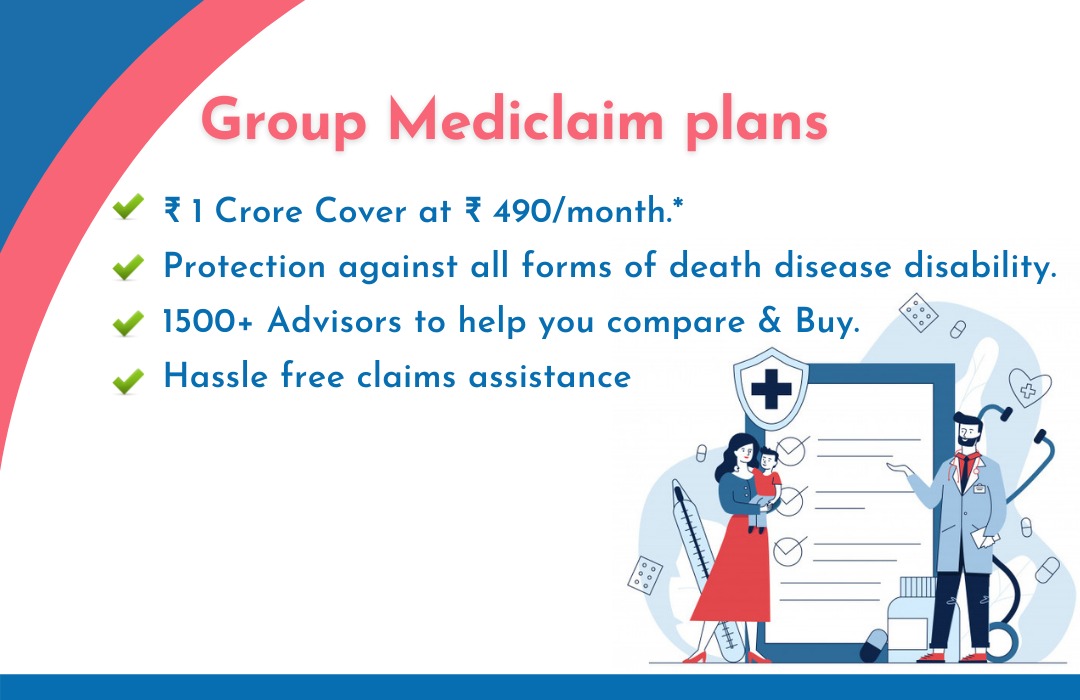

Group Mediclaim Insurance

“Health Is Wealth” is a very famous saying. Every individual tries different methods to maintain their health. However, life is full of surprises, a person can fall ill or be bedridden all of sudden, in spite of begin healthy. In such cases it leaves the person in a financially and physically mess. Therefore, it is always necessary to have a medical insurance policy for such situations. There are various types of health insurance policies available in the market and group health insurance is one.

What is Group Health Policy?

A group health insurance plan is to provide risk coverage to the people who belong to a specific group. This policy is given by employers to employees. Group health insurance policies come in different variations and every organization can customize a plan according to the requirements of its employees. There are some group health insurance plans that cover the families of the insured people as well. So, it entirely depends upon the organization what kind of group health insurance plan it selects. When the group health insurance is provided by the employer, then both employee and employer are supposed to be the beneficiary. This is because; the plan addresses both the parties of a group.

Advantages of having a Group Health Insurance Policies:

Employers:

Helps in Employee Retention:

In this age era when there are a lot of jobs in all the fields, employee retention has become a difficult task. To curb these employee attrition employers provides benefits like health insurance coverage to all its employees and their families as well, and then the chances of an employee staying in the company increase.

Tax Benefits:

Helps the employer to apply for tax benefits and it also helps the company to grow.

Motivated Employees:

In this age of high medical cost get an insurance for some elderly family members becomes difficult, however if company provides a group policy it help the employee and it motivates them to perform better.

Better Benefits in Low Cost:

Health insurance for employees provide better benefits in comparatively lesser cost than individual health insurance policy

Employees:

Pre-Existing Disease is covered from Day 1:

Individual health plan have a waiting period of a month for pre-existing diseases, whereas with a group health insurance policy starts covering pre-existing diseases from the day an employee joins the organization.

Wide Range of Coverage with No Limited on Diseases:

Apart from covering pre-existing diseases, a group health insurance plan also covers a wide range of diseases for employees.

Larger Maternity Coverage:

Most individual health policy or family policy doesn’t cover C-section during deliveries; however, these plans provide coverage for both C-section and normal deliveries. These plans also cover the newborn babies without a standard 90 days of maternity cover.

Benefits of Group policy:

Today companies are becoming employee-friendly and corporate health insurance has emerged as one of the most preferred tool to lure new talent in an organisation. It makes an employee feel part of a company; it curtails attrition rate and unrest in labor unions. It increases their productivity & profitability of a business.

- Employee health insurance companies typically cover medical benefits for insured (self), spouse, children and dependent parents.

- Group health insurance providers cover pre-existing illness and maternity.

- Employee health insurance offers cashless hospitalization at network hospitals

- Group health insurance covers ancillary charges such as ambulance costs.

Inclusions

- Pre-existing diseases are covered at time of enrolment.

- Maternity is covered.

- Hospital expenses, like room rent, day to day expenses and opd (Out patient department) are covered.

Exclusions

- Drug abuse not covered.

- AIDS not covered.

- Alcohol related issues not covered.

Articles

Other Insurance

- Business Insurance

- Burglary Insurance

- Cargo Insurance

- Contractor Risk Insurance

- Comprehensive Liability Insurance

- Cyber Insurance

- D&O Insurance

- Erection All Risk Insurance

- Fire Insurance

- Group Life Insurance

- General Liability Insurance

- Group Personal Accident Insurance

- Group Travel Insurance

- Liability Insurance

- Marine Insurance

- Office Package Policy

- Contractor's Plant & Machinery Insurance

- Shop Insurance

- Transit Insurance

- Workmen Compensation Insurance